By: Russ Kamp, Managing Director, Ryan ALM, Inc.

Inflation has moderated. That is the good news. But the current level of inflation is not yet near the Fed’s target of 2%. Despite the Fed’s effort to force inflation down with a very aggressive tightening that has seen the Fed Fund’s Rate (FFR) elevate from 0% to 5.25%-5.5%, inflation remains sticky, especially with regard to the services sector and housing.

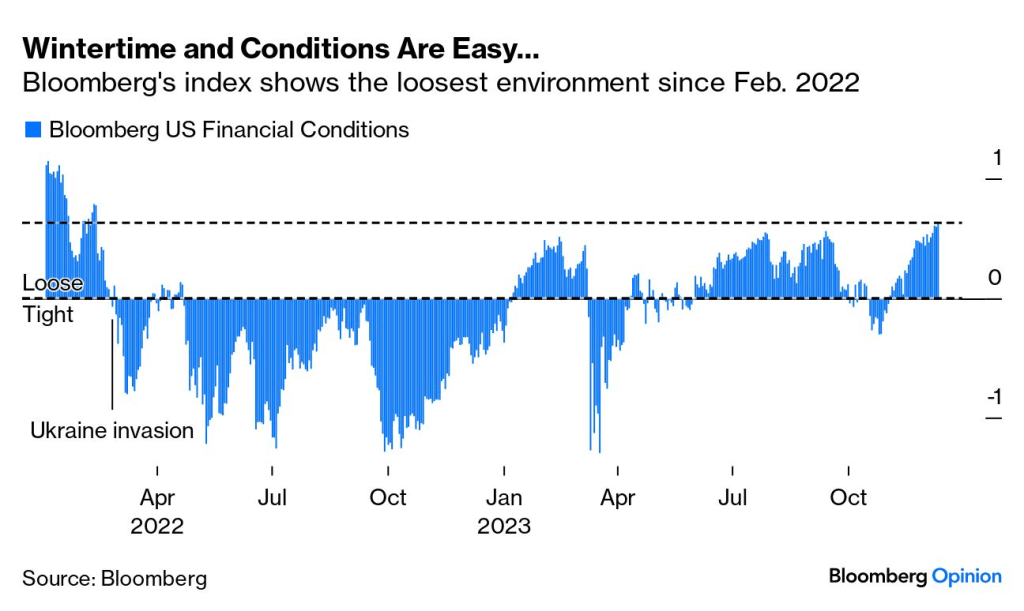

What may make the Fed’s job more challenging is the fact that the investing community feels that the Fed’s task has been achieved. It was only about 6 weeks ago that the Treasury curve had yields for the key rates at or above 5%. Today the 10-year Treasury note’s yield is 84 bps lower. The impact of falling Treasury yields and risk on trades has made the access to financing much easier. As the graph below highlights, conditions haven’t been this easy since February 2022.

Core inflation, which excludes volatile food and energy prices, rose 4.0% on an annual basis after climbing the same amount in October. This reading clearly demonstrates that the Fed’s task at hand isn’t over. Yet, the significant rally in Treasuries and the subsequent collapse in bond yields has to make the Fed’s job more challenging. There currently seems to be unanimity among the investing community that the Fed’s next action is to lower rates. Some of that feeling is based on the inflation trends and other aspects just plain hope, which has never been a great investing strategy. But how likely is that given the easing financial conditions?

Could the recent action in Treasuries force the Fed to maintain the current FFR for longer than they had anticipated? Could the easing of financial conditions and the significant deficit spending by the U.S. government (already have a $391 billion deficit for fiscal 2024 after only 2 months) counteract the progress that has been made by the Fed? Perhaps market participants should adjust their focus from the U.S. consumer and concern that they are getting stretched to the U.S. government and the stimulus that is being provided that will continue to prop up the U.S. economy.