By: Russ Kamp, Managing Director, Ryan ALM, Inc.

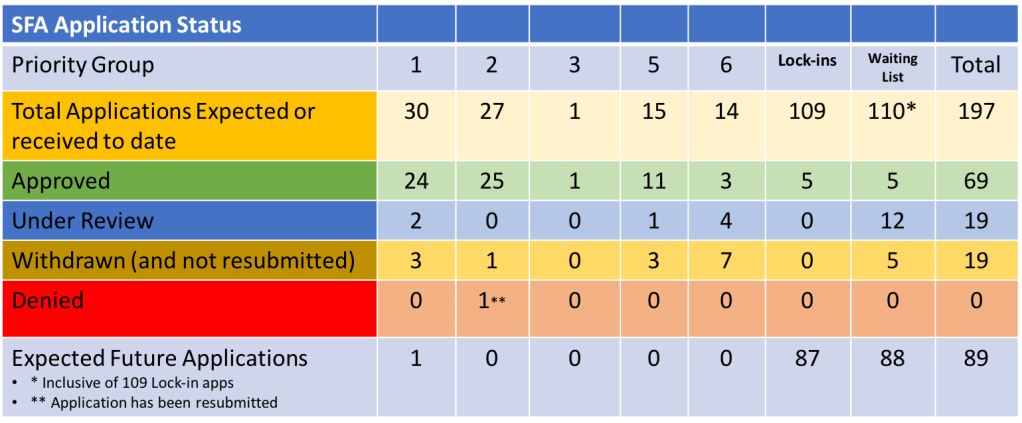

Hibernation – the condition or period of an animal or plant or the PBGC spending the winter in a dormant state. Only kidding, as I’m sure there is a tremendous amount of work going on behind closed doors by the PBGC regarding the implementation of ARPA’s Special Financial Assistance (SFA). That said, there was no activity – none – reported by the PBGC for the week ending December 8, regarding applications received, approved, denied, or withdrawn, and no new pension plans were added to the waiting list for non-priority group members.

There may not have been much noticeable activity from the PBGC, but I suspect that there is a lot going on within the various plans that have received the SFA. For those plans that didn’t use 100% investment grade (IG) bonds either in a cash flow matching (CFM) defeasement strategy or one that might have been more active versus some generic index (i.e. BB Aggregate Index), the use of equities will necessitate a rebalancing back to a 67%/33% minimum IG exposure within a 12-month period as stated in the legislation. Plans that received the SFA in 2022 will have already rebalanced, but those only getting the grant in 2023 still have a bit of time to get back within compliance.

Despite the recent rally in bonds, the selling of equities and the subsequent buying of bonds will allow plan sponsors to sell high and buy low, as equities have performed well, especially if the money was invested in the S&P 500 index and buy bonds at lower prices as yields are up during the last 12 months.