By: Russ Kamp, Managing Director, Ryan ALM, Inc.

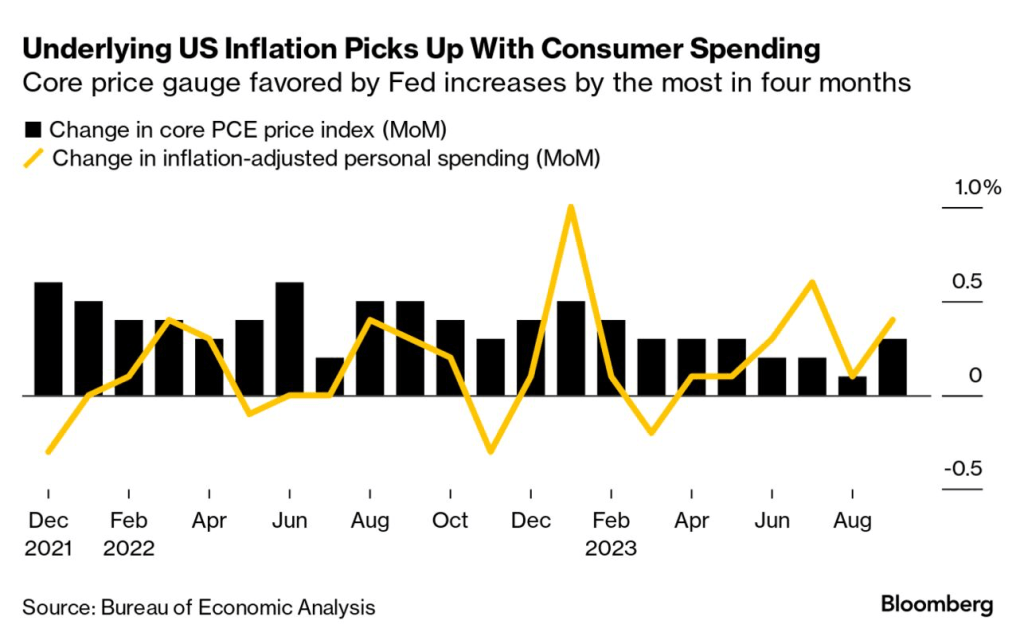

The FOMC has paused additional increases since July, but that doesn’t necessarily mean that they have been victorious in their quest to defeat inflation. If 2% is the Fed’s line in the sand, they still have quite a bit to accomplish. There has certainly been progress made since last summer, but not enough at this time to feel confident that future increases in the FOMC’s FFR aren’t necessary. Recent economic data belie the broad expectations of a US recession. Furthermore, the Fed’s “preferred” measure of inflation, the core personal consumption expenditures (PCE) price index, which strips out the volatile food and energy components, rose 0.3% in September, according to a new Bureau of Economic Analysis report. Please note that the Food & Energy components rose by 6.7% annualized in September.

As of the writing of this post, each of the key rates on the Treasury yield curve are up, with the 10-year Treasury note yield up just over 5 bps to 4.89%. As we wrote last week, 5% Treasury yields are meaningful. As investment-grade corporate bond yields eclipse 6%, bonds become a significant alternative to equities in asset allocation strategies, especially for pension plan sponsors looking to SECURE the promised benefits through a cash flow matching (CFM) strategy.

None of us know where US interest rates and inflation will be in 6-12 months. Why assume the investment risks of a traditional asset allocation in which all of a plan’s assets are focused on the return on asset (ROA) objective. Bifurcate the plan’s assets into liquidity and growth (Alpha) buckets. Use CFM to ensure that the promises have been secured and the liquidity is available to meet those monthly needs. Doing so “buys time” for the Alpha assets to grow unencumbered. As you know, time is your friend, at least in an investing sense, and the more time that we give to an investment strategy the greater the probability of success.