By: Russ Kamp, Managing Director, Ryan ALM, Inc.

This week brings us Halloween and the markets may provide both “tricks and treats”, but the PBGC continues to hand out treats in the form of SFA grants to multiemployer plans. There wasn’t a lot of activity last week, but any action is good for the plan participants who continue to hope for a secure retirement.

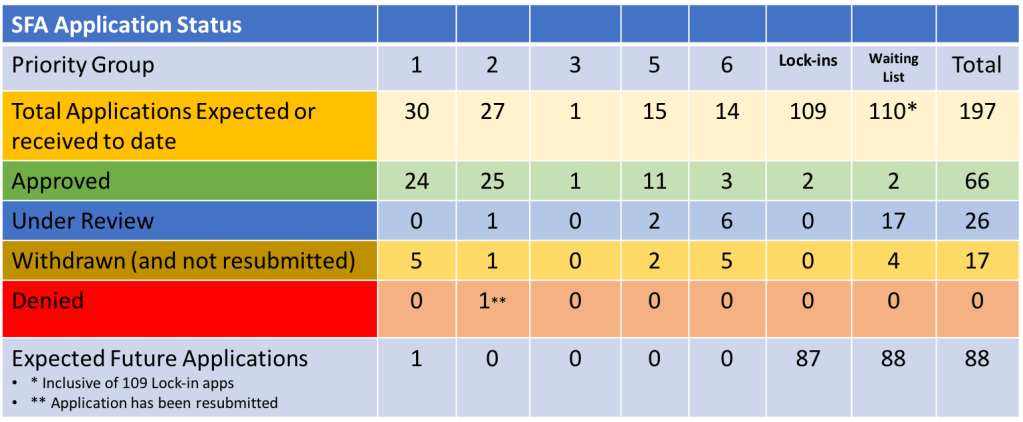

According to the latest update by the PBGC, there was one plan, Local 210’s Pension Plan, a priority Group 5 member, received approval for its revised SFA application. Local 210 will receive $49.3 million for the plan’s 3,887 participants. In other news, United Food and Commercial Workers Unions and Employers Pension Plan’s application is now under review. This plan is seeking more than $74 million for its 15,420 participants. While the UFCW application proceeds through the review process, two other funds have withdrawn applications, including the Southwestern Pennsylvania and Western Maryland Area Teamsters and Employers Pension Fund and the Pacific Coast Shipyards Pension Plan. Southwestern’s application had already been revised. Perhaps three times will prove to be the charm.

There was a presentation delivered at the recently concluded IFEBP annual conference in Boston that addressed LDI broadly. At the end of the presentation there were a series of questions listed that went unanswered. Here is one of those: Can this concept (LDI) be applied to SFA assets? If the presenter was referring to cash flow matching as the LDI strategy then the answer is unequivocally, YES! In fact, it should be the only strategy considered for the SFA bucket, as it is a sinking fund designed to fund benefits and expenses chronologically as far into the future as the SFA will go. Please DON’T assume unnecessary market risk by investing in equity or return-seeking fixed income strategies, as the potential “reward” is minimal versus the pain of not being able to secure benefits for as long as possible.