By: Russ Kamp, Managing Director, Ryan ALM, Inc.

From basically the time that I entered our industry (October 13, 1981) to the end of 2021, US interest rates were on a decline. Sure, there were modest periods in which the Fed tightened, such as 1994, but for the most part the investment community enjoyed the benefits of falling rates and low inflation for nearly four decades. The returns associated with investing in bonds from that period forward were quite beneficial for pension plans. How times have changed!

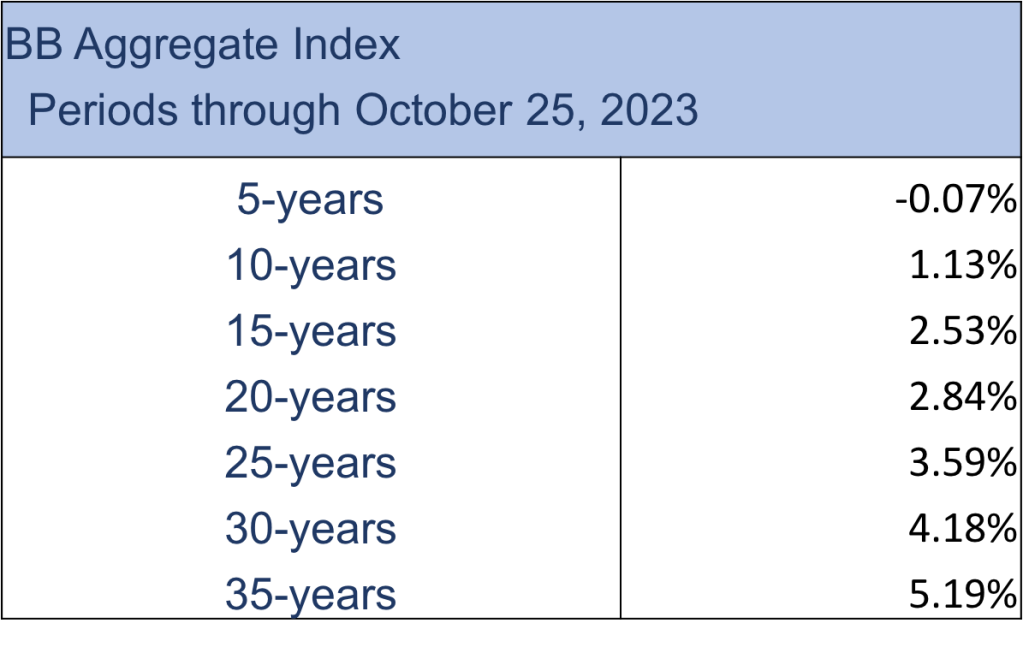

Since the Federal Reserve began raising rates on March 17, 2022, the aggregate index has witnessed its worst calendar year return ever at -13.0% in 2022 and it is on the verge of producing the second worst calendar year performance in 2023. Prior to this interest rate move, the worst return experienced on a calendar year basis had been 1994’s -2.9%. Again, how times have changed. As the table below highlights, one would have to go back 35 years from yesterday (October 1988) to have gotten a 5+% annualized return for any period of length.

That said, today’s rate environment is presenting plan sponsors with a terrific entry point, as most yields are close to the 5% level and investment grade corporate yields are close to 6% or more at this time. As a reminder, a bond purchased at par and allowed to mature will generate a return equal to the bond’s yield. Buying a bond in this environment will provide plan sponsors with the opportunity to capture a significant percentage of the target ROA without an abundance of risk.

At Ryan ALM, Inc. we would suggest that bonds should not be looked at as return-seeking instruments. They have known cash flows of interest and principal and those can be used to defease a pension plan’s liability cash flows with certainty. The current interest rate environment is providing pension plan sponsors and their advisors with a wonderful opportunity to SECURE the promised benefits at significantly reduced cost. As we highlighted in the recent blog post “Just the Facts”, it is not unheard of to reduce the present value cost of those future value benefits by 50% or more depending on how far into the future that the cash flow matching program covers.

The current level of rates may not rival the double-digit rates available in 1981, but they are certainly quite attractive relative to the Covid-19 induced historically low levels. Use the current rate environment to secure the promises made to your participants and bring certainty to a very uncertain investing environment.

Pingback: No Victory, Yet – Ryan ALM Blog