By: Russ Kamp, Managing Director, Ryan ALM, Inc.

Sgt. Joe Friday, Dragnet, is credited with saying, “Just the facts, Ma’am”, but he actually never uttered the phrase. However, that wording did appear in the movie starring Tom Hanks and Dan Aykroyd (1987). Why mention this? Well, investment management firms may be better at marketing/sales than they are at actually managing investment products. Spin wins! However, in this challenging investment environment, getting “just the facts” is incredibly important.

I’ve produced more than 1,300 blog posts and many, if not most, are focused on how plan sponsors and their advisors can secure the pension promise, reduce funding cost, while maintaining prudent levels of risk. Does this seem too good to be true? It’s not, especially today with US interest rates at nearly a two decade high. Securing the promises at a reasonable cost and with prudent risk is very achievable. Here are the facts based on a recent analysis that we completed for a large public pension system.

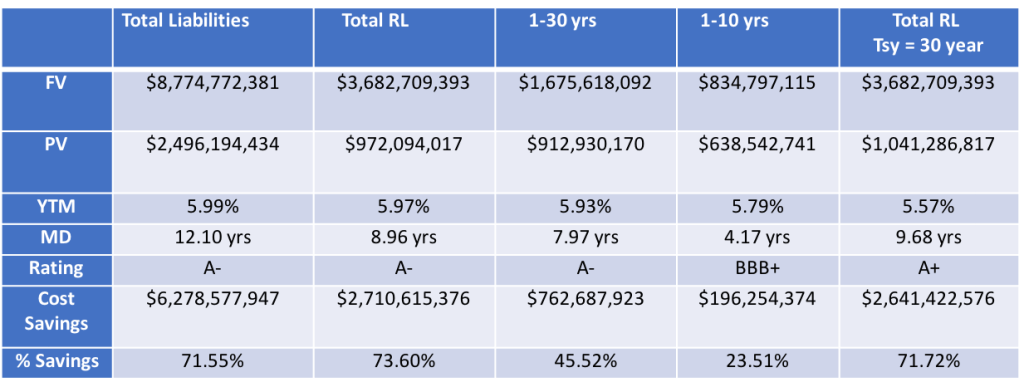

Their defined benefit fund has roughly $2.1 billion in AUM. The total estimated liabilities going out beyond 2100 have a future value (FV) of $8.8 billion, while the Retired Lives Liability (RLL) carries a FV of $3.7 billion.

As the table below highlights, we can defease all of the RLL at a present value (PV) cost of $972 million. This equates to a cost reduction of 73.6% or $2.7 billion. Yes, some will say that the “savings” are nothing more than the time value of money. However, when one defeases pension liabilities, the “savings” are realized immediately and generated with little risk through an investment grade bond portfolio, unlike a traditional asset allocation and the volatility associated with that process. Furthermore, we can tell you what the return will be on the portfolio on day 1! Is there any other strategy that can do that?

If securing all of the RLL is not a desired goal at this time, we can defease any series of years that you desire. Again, in the table below, we have defeased liabilities for 10- and 30-years. The cost savings reduction is quite meaningful. The cost savings will always be more robust the longer the maturity of the program. Bond math is very straightforward: the longer the maturity and higher the yield, the lower the cost.

As a plan sponsor, why wouldn’t you want to SECURE the promises made to your participants? Why wouldn’t you want to reduce funding costs significantly? Why would you want to continue investing in the capital markets with all of the uncertainty that brings? How comforting it would be for all involved in the process to know that the RLL has been fully defeased. The yields highlighted above are robust. Take advantage of those. Don’t let this opportunity pass as we’ve done on multiple occasions before.

I’ve presented the facts. We’d be happy to generate a similar analysis for you at no cost to complete the review. Call us.