By: Russ Kamp, Managing Director, Ryan ALM, Inc.

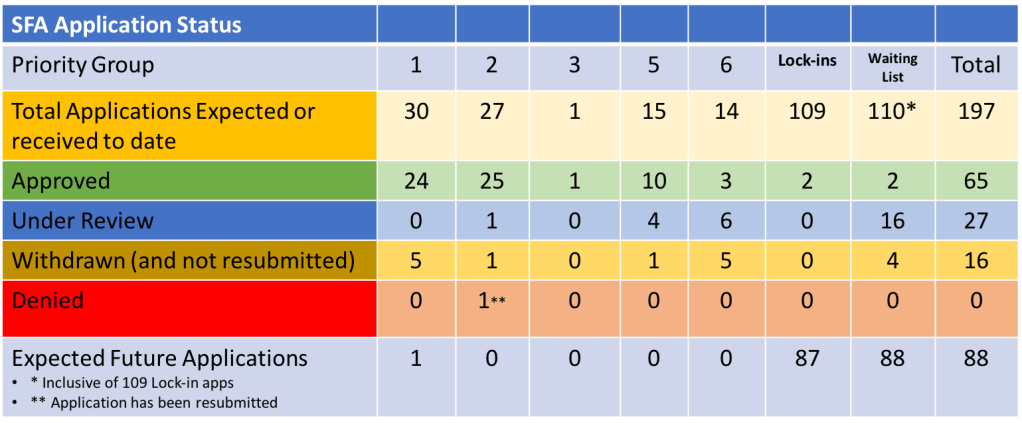

It is the week before Halloween, but things are already scary for the US capital markets, as rising US interest rates continue to create uncertainty for bonds, equities, real estate (particularly housing), and other investments. Fortunately, the implementation of the ARPA legislation continues unabated as the PBGC allowed for the submission of five more applications for Special Financial Assistance (SFA). Each of those applications came from the waiting list and included, CWA/ITU Negotiated Pension Plan, Local 1034 Pension Plan, Kansas Construction Trades Open End Pension Trust Fund, Local 945 I.B. of T. Pension Plan, and the Radio, Television and Recording Arts Pension Plan. These pension funds are collectively seeking $710 million for just over 37,000 plan participants. Presently, there are 27 applications under review by the PBGC.

In other news during the prior week, there were no applications approved or denied. Furthermore, there were no new additions to the waiting list. There were, however, 3 funds that withdrew the SFA applications, including, CWA/ITU Negotiated Pension Plan, UFCW – Northern California Employers Joint Pension Plan, and the Retail Food Employers and United Food and Commercial Workers Local 711 Pension Plan. In total, they are seeking $2.9 billion for roughly 188,000 participants. The largest of these by far is the UFCW plan of Northern California (seeking $2.3 B in SFA).

It is easy to get lost in the large $s associated with this legislation, but it is critically important to remember that 1,396,465 plan participants are in these pension plans that have either received the SFA (959,286) or are in the review queue, with many, many more to come. This legislation is truly life-saving in many cases. Please refer back to previous blog posts that highlighted Carol’s plight.