By: Russ Kamp, Managing Director, Ryan ALM, Inc.

The last 18 or so months have played havoc with total return-seeking fixed income strategies as US interest rates have risen precipitously from the depths of Covid-19-induced lows. In fact, there is the chance (likelihood) that the Aggregate Index may suffer losses for the third consecutive year. A performance outcome that has never been witnessed in the history of the index. As a reminder, 2021 saw the index fall by -1.5%, 2022 was a whopping -13.0% (largest decline in the index’s history, while the Agg is currently (as of 9/21) down -1.6% YTD.

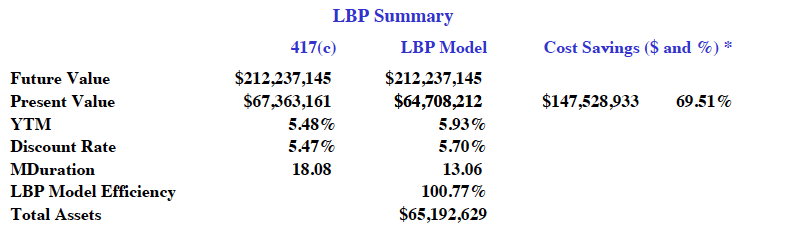

However, for fixed income ALM specialists, such as Ryan ALM, we are celebrating the rise in rates as the cash flows produced are providing excellent coverage for future benefits and expenses at lower and lower funding costs. In fact, one has to go back roughly two decades to find an environment this attractive. Within the last few days, we produced a Liability Beta Portfolio™ (our proprietary cash flow matching (CFM) product) that was asked to defease all of a plan’s $212 million in projected benefit payments. Given the extraordinary rise in rates, our modeling suggests that we can cash flow match all of the liabilities for ONLY $65 million as the present value of our LBP model to fully fund those future benefit payments is $64.7 million – extraordinary! The plan has $88 million in assets. This plan is well over funded producing an outcome which I’m sure was not anticipated.

As the information above highlights, the difference between the LBP PV and FV of those benefit payments is $147.5 million or 69.5% cost savings. Furthermore, the cost savings are locked in on the day that the portfolio is built. How many investment managers can tell you what their performance will be for the entire life of the program on the first day of the assignment? Given today’s YTM of nearly 6%, one can achieve a significant portion of the return on asset (ROA) assumption with minimal risk (IG credit risk which remains quite low).

Don’t continue to subject all of the plan’s assets to the whims of the market, especially given all of the uncertainty that presently exists. Take some of that risk off the table and utilize the cash flows of income and principal created by the higher US interest rates to defease a portion of your plan’s liabilities through a cash flow matching implementation. I’m sure that you will be quite surprised by the cost reduction to defease those liabilities. Assets not used to support the CFM program can now be managed more aggressively given the extended investing horizon.

Pension America needs to get off the asset allocation rollercoaster. Utilizing a cash flow matching strategy for a portion of the assets, if total defeasement isn’t the goal, is certainly a great first step. We are here to help. Let us model your plan’s liabilities. I think that you’ll be pleasantly surprised by what we reveal. Get ready for a great night’s sleep!