By: Russ Kamp, Managing Director, Ryan ALM, Inc.

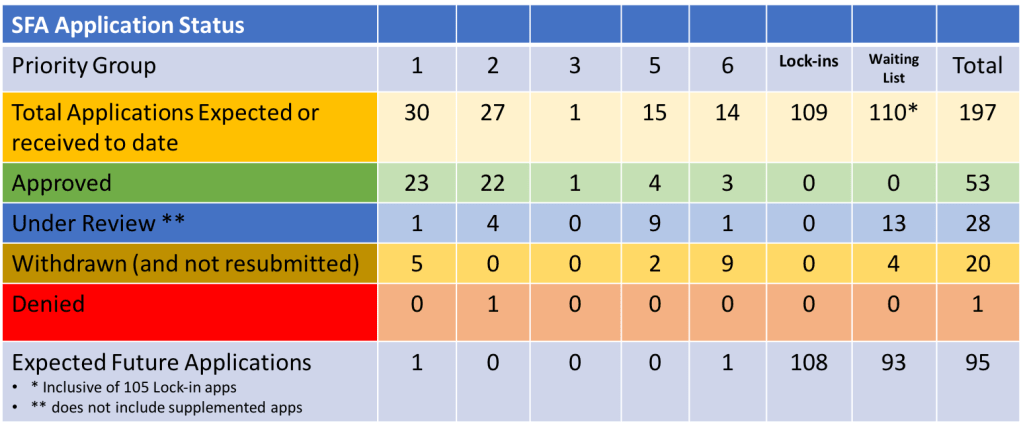

We are pleased to provide you with the weekly update on the PBGC’s progress implementing the ARPA legislation passed in March 2021. The program to distribute the Special Financial Assistance (SFA) has been under way since July 2021. To date, 53 funds have received SFA proceeds. There is still a lot more to do, but the PBGC continues to make good progress and this past week is no exception.

There were an additional four funds on the waiting list that had their window opened to submit applications. These funds are Local 360 Labor-Management Pension Plan, Twin Cities Bakery Drivers Pension Plan, United Association of Plumbers and Pipefitters Local 51 Pension Fund, and the United Food and Commercial Workers Union Local 152 Retail Meat Pension Plan. In addition, Priority Group 5 member, Pension Plan of the Moving Picture Machine Operators Union Local 306 submitted its revised application. In total, these plans are seeking $358.8 million for nearly 20,000 plan participants.

There were no applications approved last week and happily none denied. Furthermore, there were no additions to the waiting list, which continues to have 110 names listed, but there was one fund on the list, San Francisco Lithographers Pension Trust, that had its name crossed off, as it already received SFA back in 2021. Finally, there was one fund that secured its valuation date. Pension Plan of International Union of Bricklayers & Allied Craftworkers Local #15 PA has chosen April 30, 2023 for their SFA measurement date.

The current US interest rate environment is providing these plans and their advisors a wonderful opportunity to secure the promised benefits chronologically as the legislation intended. We produced a post last week that highlights the fact that most of a plans ROA could be covered by a defeased bond portfolio. The same is true for the SFA assets that can cover far more liabilities today than just 16 months ago prior to the Fed’s aggressive action to increase rates. There is no reason to take on equity risk within this segregated portfolio.