By: Russ Kamp, Managing Director, Ryan ALM, Inc.

We hope that your week has begun well. Sorry for the delay in getting our weekly ARPA update out. Three cancelled planes, flights supposedly from 4 different airports, an Amtrak train, and numerous Uber rides, and I finally made it to Orlando, FL for the FPPTA conference. What a journey. Travel in the summer is far worse than trying to get around in the winter.

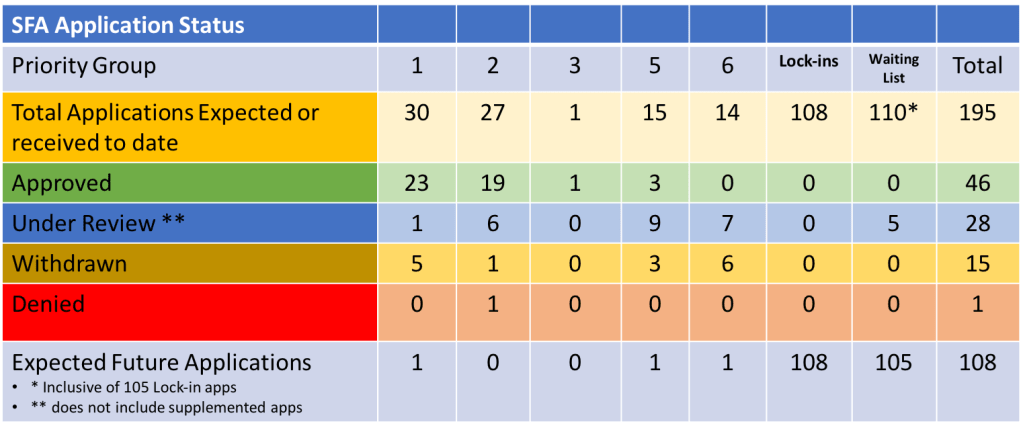

Well, the wait might not have been worth it, as there is very little activity to report from last week. According to the PBGC’s website, there were no new applications filed or approved, and none denied. There were two initial applications withdrawn. Both had been filed on March 10, 2023. The Southern California United Food and Commercial Workers Unions and Food Employers Joint Pension Plan (UFCW), a Priority Group 6 plan, is seeking nearly $1.2 billion in Special Financial Assistance (SFA) for its 193,302 plan participants. They withdrew their application on June 21st. The Union de Tronquistas de Puerto Rico Local 901 Pension Plan, a Priority Group 1 plan (insolvency), is seeking $38.6 million for the 4,029 members of the plan. They withdrew their application on June 23rd.

There were no new additions to the waitlist, which continues to have 110 members. Of those 110, all but two funds have locked in valuation dates. According to the PBGC’s website, the e-filing portal is temporarily closed, but plans “plans may request to be placed on the waiting list in accordance with the instructions in PBGC guidance.”

As of last week, five of the 110 funds residing on the waitlist had submitted applications to the PBGC. Those plans included, Laborers’ International Union of North America Local Union No. 1822 Pension Fund, Teamsters Local 11’s Pension Plan, UFCW Regional Pension Fund, IUE-CWA Pension Plan, and the Newspaper Guild International Pension Plan. I believe that the PBGC has 120 days to approve or reject the applications which has been the operating procedure for priority group plans (1-6).

We encourage any multiemployer plan going through the process of receiving and investing the SFA to reach out to us for guidance. Cash Flow Matching is the most appropriate investment strategy, as the segregated SFA proceeds represent a sinking fund designed to pay benefits and expenses as far into the future as the allocation will go. Minimizing volatility of the corpus is critically important to ensuring the success of this program.